Scroll to find all Home Equity Rates below

Home Equity Loans

Effective Date: November 8, 2024

*APR = Annual Percentage Rate

| Loan Type | APR* | Monthly payment per $10,000 |

|---|---|---|

| 5 Year Fixed | as low as 7.307% | $199.46 |

| 10 Year Fixed | as low as 7.411% | $118.24 |

| 15 Year Fixed | as low as 7.868% | $94.80 |

*APR = Annual Percentage Rate. Rate is fixed for the term of the loan. Advertised rate is current as of 11/8/2024. Actual rate is based on applicant’s credit score, term of loan, and loan to value. Loan is subject to credit approval. Qualifications and limitations may apply. Credit Union membership required. Rates and terms subject to change. Borrow at 7.307% APR for 5 years and make monthly payments of $199.46 per $10,000 borrowed. Payments do not include amounts for taxes and insurance premiums, if applicable, and the actual payment obligation will be greater. Minimum loan amount $10,000; maximum loan amount $500,000. Borrower pays all applicable closing costs and range $350 to $5100. Homeowners insurance required. Offer valid only for residential properties located in Minnesota and Pierce, Polk, St. Croix, Bayfield, Burnett, Washburn, Douglas, Barron and Ashland Counties of Wisconsin.

Home Equity Line of Credit

*APR = Annual Percentage Rate

| APR* | Monthly Payment Per $10,000 |

|---|---|

| Rates as low as 7.25% | $125.00 |

*APR = Annual Percentage Rate. Advertised rate is current as of 11/8/2024. Actual rate is based on applicant’s credit score, term of loan, and Loan to Value. Loan is subject to credit approval. Rates and terms subject to change. Credit Union membership required. Minimum first advance required $5,000, minimum additional advances $500. Rates become variable after the initial 12-month term and adjust quarterly. Payments adjust monthly for the first 10 years, then annually, thereafter. During repayment, the payment will be calculated annually on the current rate, balance owed and maturity date. Rates based on Prime plus or minus a margin. Estimated monthly payments of $125.00 per $10,000 borrowed. ***10 year draw period followed by a 5 year repayment period. Payments are based on 1.25% of the principal balance as of the 30th of the month. Finance charges begin to accrue on the day an advance is made on the line. No annual fee. Minimum rate 3.50% APR (floor); maximum rate 18.00% APR. Minimum loan amount $10,000; maximum loan amount $500,000. Borrower pays all applicable closing costs and range $350 to $5,100. Homeowners insurance required. Offer valid only for residential properties located in Minnesota and Pierce, Polk, St. Croix, Burnett, Washburn, Douglas, Bayfield, Barron and Ashland Counties of Wisconsin.

Home Equity Line of Credit Special Offer

*APR = Annual Percentage Rate

| APR* | Monthly Payment Per $10,000 |

|---|---|

|

Introductory Rate for the 1st 12 Months as Low as 5.99%** Current non-introductory rate 7.25% APR |

$125.00 |

*APR = Annual Percentage rate. Advertised rate is current as of 11/8/2024. Actual rate is based on applicant’s credit score, term of loan, and Loan to Value. **Introductory rate for the 1st 12 Months as low as 5.99% APR for twelve months then Prime -0.50% (currently 7.75%% APR). The current non introductory variable rate is as low as 7.25% APR and is based on applicant's credit score and loan to value. Loan is subject to credit approval. Offer limited to 80% Loan to Value or less. Rates and terms subject to change. Credit Union membership required. Minimum first advance required $5,000, minimum additional advances $500. Borrow at an introductory rate for the 1st 12 Months as low as 5.99% APR; estimated monthly payments of $125.00 per $10,000 borrowed. ***10 year draw period followed by a 5 year repayment period. Payments are based on 1.25% of the principal balance as of the 30th of the month. Rates become variable after the initial 12-month term and adjust quarterly. Payments adjust monthly for the first 10 years, then annually, thereafter. During repayment, the payment will be calculated annually on the current rate, balance owed and maturity date. Rates based on Prime plus or minus a margin. Finance charges begin to accrue on the day an advance is made on the line. No annual fee. Minimum non introductory rate 7.25% APR; maximum rate 18.00% APR. Minimum loan amount $10,000; maximum loan amount $500,000. Borrower pays all applicable closing costs and range $350 to $5,100. Homeowners insurance required. Offer valid only for residential properties located in Minnesota and Pierce, Polk, St. Croix, Burnett, Washburn, Douglas, Bayfield, Barron and Ashland Counties of Wisconsin.

Scroll to find all Vehicle Loan Rates below

Auto Loan Rates

Effective Date: November 8, 2024

*APR= Annual Percentage Rate

Maximum Loan to Value = 125% for qualified borrowers

| Model Year | APR* | Term | Monthly Payment Per $1000 |

|---|---|---|---|

| 2020 & Newer | Rates as low as 5.24% | 1 - 24 Months | $43.98 |

| Rates as low as 5.74% | 25 - 36 Months | $30.30 | |

| Rates as low as 6.39% | 37 - 48 Months | $23.66 | |

| Rates as low as 6.49% | 49 - 60 Months | $19.56 | |

| Rates as low as 6.79% | 61 - 72 Months | $16.95 | |

| Rates as low as 7.29% | 73 - 84 Months+ | $15.23 | |

| 2019 - 2018 | Rates as low as 5.74% | 1 - 24 Months | $44.20 |

| Rates as low as 6.24% | 25 - 36 Months | $30.53 | |

| Rates as low as 6.89% | 37 - 48 Months | $23.90 | |

| Rates as low as 6.99% | 49 - 60 Months | $19.80 | |

| Rates as low as 7.29% | 61 - 72 Months | $17.19 | |

| 2017 - 2015 | Rates as low as 6.24% | 1 - 24 Months | $44.43 |

| Rates as low as 6.74% | 25 - 36 Months | $30.76 | |

| Rates as low as 7.39% | 37 - 48 Months | $24.13 | |

| Rates as low as 7.74% | 49 - 60 Months | $20.15 | |

| 2014 - 2010 | Rates as low as 6.99% | 1 - 24 Months | $44.77 |

| Rates as low as 7.49% | 25 - 36 Months | $31.10 | |

| Rates as low as 8.14% | 37 - 48 Months | $24.48 |

*APR = Annual Percentage Rate. Advertised rate is current as of 11/8/2024 and is fixed for the term of the loan. Borrow at 5.24% APR for 24 monthly payments of $43.98 per $1,000 borrowed. Rates include a .25% discount for auto paying electronically from an Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union or TopLine Financial Credit Union. Loan is subject to approval and the rate may vary based on individual credit and term. Certain restrictions may apply. No minimum loan amount. Maximum loan amount $100,000. Payments may be deferred upon credit approval for up to 90 days. Deferred payments may not exceed 90 days. Interest begins accruing upon disbursal of loan. Offer valid on new and used auto loans. Credit Union Membership required. Offer not valid on loans currently financed with Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union or TopLine Financial Credit Union. Offer subject to change or termination.

⁺Minimum loan amount for 84 month term is $25,000. Vehicle must be 2020 or newer with less than 50,000 miles.

Drive4Less Auto Loan Rates

*APR= Annual Percentage Rate

| Model Year | APR* | Term | Monthly Payment Per $1000 |

|---|---|---|---|

| 2019 - 2024 | Rates as low as 5.99% | 1 - 24 Months | $44.32 |

| Rates as low as 7.14% | 25 - 48 Months | $24.01 | |

| Rates as low as 7.24% | 49 - 60 Months | $19.91 | |

| Rates as low as 7.54% | 61 - 72 Months | $17.31 |

*APR = Annual Percentage Rate. Advertised rate is current as of 11/8/2024 and is fixed for the term of the loan. All loans are subject to Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union's lending policies. Verification of income may be required. Offer, rate, and terms are subject to change. If you elect to return the vehicle at the end of the term, additional fees may apply. The Drive4Less program is valid for autos and trucks up to 5 years old. Mileage restrictions may apply. Credit Union Membership is required to participate in this program. Sample payment of 3.14% APR would require 72 monthly payments of $299 for a $15,000 loan. A one-time fee of $325.00 will be charged and added to financing.

Recreational Vehicle Loan Rates

*APR= Annual Percentage Rate

Titled & Non-Titled Recreational Vehicles 2018 - 2024

Motorcycles, Camper, Boat, Travel Trailers, Horse Trailer, Jetski, ATV, Snowmobile, Ice/Fish House

| Model Year | APR* | Term | Monthly Payment Per $1000 |

|---|---|---|---|

| 2018-2024 | Rates as low as 5.74% | 1 - 24 Months | $44.20 |

| Rates as low as 5.99% | 25 - 36 Months | $29.94 | |

| Rates as low as 6.49% | 37 - 48 Months | $23.32 | |

| Rates as low as 6.99% | 49 - 60 Months | $19.44 | |

| Rates as low as 7.49% | 61 - 72 Months | $16.78 | |

| Rates as low as 7.99% | 73 - 84 Months | $15.01 | |

| Rates as low as 8.24% | 85 - 96 Months | $13.70 | |

| Rates as low as 8.49% | 97 - 138 Months | $12.73 | |

| Rates as low as 8.74% | 139 - 180 Months | $12.00 |

*APR = Annual Percentage Rate. Advertised rate is current as of 11/8/2024 and is fixed for the term of the loan. Borrow at 5.74% APR for 24 monthly payments of $44.20 per $1,000 borrowed. Rates include a .25% discount for auto paying electronically. Loan is subject to approval and the rate may vary based on individual credit and term. Certain restrictions may apply. No minimum loan amount. Maximum loan amount $100,000. Payments may be deferred upon credit approval for up to 90 days. Deferred payments may not exceed 90 days. Interest begins accruing upon disbursal of loan. Offer valid on new and used recreational vehicle loans. Credit Union Membership required. Offer not valid on loans currently financed with Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union or TopLine Financial Credit Union. Offer subject to change or termination.

Scroll to find all Personal Loan Rates below

Unsecured Loan Rates

Effective Date: November 8, 2024

*APR = Annual Percentage Rate

| Loan Type | APR* | Monthly Payment Per $1000 |

|---|---|---|

| Rapid Advance Line of Credit1 | Rates as low as 11.25% | $40.00 |

| Signature Loan2 | Rates as low as 12.24% | $22.37 |

1Rapid Advance Line of Credit. APR = Annual Percentage Rate. 11.25% APR is our lowest available rate as of 11/8/2024. Rate adjusts monthly based on prime plus a margin and applies to the entire outstanding balance. Maximum rate is 18.00% APR. Rate is variable. Finance charge begins to accrue on the day an advance is made on the line. Late Fee $25, and Returned Payment Fee $33, No annual fee. Minimum loan amount $500; maximum loan amount $100,000. Payments are calculated on 2% of the outstanding balance or $25, whichever is greater. Your Rapid Advance Line of Credit is subject to approval and the rate may vary based on your individual credit, term, and relationship level. Certain restrictions may apply. Not valid on tuition expenses and interest is not tax deductible. Credit Union Membership required. Does not apply to loans with Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union or TopLine Financial Credit Union. Offer subject to change or termination.

2Signature Loan. APR = Annual Percentage Rate. Advertised rate is current as of 11/8/2024 and is fixed for the term of the loan. Borrow at 12.24% APR for 60 monthly payments of $22.37 per $1,000 borrowed. Rates include a .25% discount for auto paying electronically. Loan is subject to approval and the rate may vary based on individual credit and term. Certain restrictions may apply. No minimum loan amount; maximum loan amount of $25,000. Payments may be deferred upon credit approval for up to 90 days. Deferred payments may not exceed 90 days. Interest begins accruing upon disbursal of loan. Credit Union Membership required. Does not apply to loans with Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union or TopLine Financial Credit Union Offer subject to change to or termination.

Secured Loan Rates

Effective Date: November 8, 2024

*APR = Annual Percentage Rate

| Type | APR* | Term | Monthly Payment Per $1000 |

|---|---|---|---|

| Share Secured Up to 100% of available shares. |

As low as 2.81% | Up to 60 Months | $84.61 |

| Certificate Secured Up to 100% of certificate. |

As low as 5.65% | Up to 60 Months | $85.91 |

Share Secured. *APR = Annual Percentage Rate. Advertised rate is current as of 11/8/2024 and is fixed for the term of the loan and is based on 3% over the current account APY. Borrow at 2.81% APR for 12 monthly payments of $84.61 per $1,000 borrowed. Rates include a .25% discount for auto paying electronically. Loan is subject to approval and the rate may vary based on individual credit and term. Certain restrictions may apply. Minimum loan amount $500. No maximum loan amount. Loan is secured by up to 100% of available shares. Payments may be deferred upon credit approval for up to 90 days. Deferred payments may not exceed 90 days. Interest begins accruing upon disbursal of loan. Credit Union Membership required. Does not apply to loans with Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union or TopLine Financial Credit Union. Offer subject to change or termination.

Certificate Secured. *APR = Annual Percentage Rate. Advertised rate is current as of 11/8/2024 and is fixed for the term of the loan and is based on 3% over the current account APY. Borrow at 5.65% APR for 12 monthly payments of $85.91 per $1,000 borrowed. Rates include a .25% discount for auto paying electronically. Loan is subject to approval and the rate may vary based on individual credit and term. Certain restrictions may apply. Minimum loan amount $1,000. No maximum loan amount. Loan is secured by up to 100% of share certificate and is limited to the term of the certificate. Payments may be deferred upon credit approval for up to 90 days. Deferred payments may not exceed 90 days. Term of loan cannot exceed the term of the certificate. Interest begins accruing upon disbursal of loan. Credit Union Membership required. Does not apply to loans with Anoka Hennepin Credit Union, a Division of TopLine Financial Credit Union or TopLine Financial Credit Union. Offer subject to change or termination.

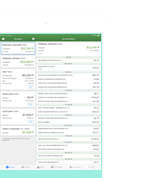

Credit Cards

Effective Date: November 8, 2024

| Interest Rates and Interest Charges |  |

|---|---|

|

Annual Percentage Rate (APR) for Purchases |

Platinum Mastercard 8.90%Gold Mastercard 11.90% |

|

APR for Balance Transfers |

Platinum Mastercard 8.90%Gold Mastercard 11.90% |

|

APR for Cash Advances |

Platinum Mastercard 8.90%Gold Mastercard 11.90% |

|

How to Avoid Paying Interest on Purchases |

Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month. |

|

Minimum Interest Charge |

If you are charged interest, the charge will be no less than $0.50. |

|

For Credit Card Tips from the Consumer Financial Protection Bureau |

To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore. |

|

Fees |

|

|

Transaction Fees - Cash Advance Fee

- Foreign Transaction Fee |

$2.00 or 2.00% of the amount of each cash advance, whichever is greater (Maximum Fee: $25.00) 1.00% of each transaction in U.S. dollars |

|

Penalty Fees - Late Payment Fee - Returned Payment Fee |

Up to $25.00 Up to $25.00 |

How We Will Calculate Your Balance:

We use a method called "average

daily balance (including new purchases)."

Minimum Interest Charge:

The minimum interest charge will be charged on

any dollar amount.

Effective Date:

The information about the costs of the card described in

this application is accurate as of: April 1, 2016

This information may have

changed after that date. To find out what may have changed, contact the Credit Union.

For California Borrowers, the Platinum Mastercard and Gold Mastercard are secured credit cards. Credit extended under this credit card account is secured by various personal property and money including, but not limited to: (a) any goods you purchase with this account, (b) any shares you specifically pledge as collateral for this account on a separate Pledge of Shares, (c) all shares you have in any individual or joint account with the Credit Union excluding shares in an Individual Retirement Account or in any other account that would lose special tax treatment under state or federal law, and (d) collateral securing other loans you have with the Credit Union excluding dwellings. Notwithstanding the foregoing, you acknowledge and agree that during any periods when you are a covered borrower under the Military Lending Act your credit card will be secured by any specific Pledge of Shares you grant us but will not be secured by all shares you have in any individual or joint account with the Credit Union. For clarity, you will not be deemed a covered borrower if: (i) you establish your credit card account when you are not a covered borrower; or (ii) you cease to be a covered borrower.

Other Fees & Disclosures:

Late Payment Fee:

$25.00 or the amount of the required

minimum payment, whichever is less, if you are seven or more days late in making a payment.

Cash Advance Fee (Finance Charge):

$2.00 or 2.00% of the amount of each cash

advance, whichever is greater, however, the fee will never exceed $25.00.

Returned Payment Fee:

$25.00 or the amount of the required minimum payment,

whichever is less.

Card Replacement Fee:

$8.95.

Document Copy Fee:

$5.00.

Rush Fee:

$65.00.

Statement Copy Fee:

$5.00.

Mastercard and the Mastercard Brand Mark are registered trademarks of Mastercard International Incorporated.

Disclosures

MasterCard Application and Solicitation Agreement

Scroll to find all Savings & Checking Rates below

Savings Rates

Effective Date: November 1, 2024

Rate means Dividend Rate

^APY means Annual Percentage Yield

All rates are shown as anticipated dividends. APY is shown as anticipated annual percentage yield. Conditions and rates are subject to change at any time.

See fee schedule for a list of applicable fees you may encounter.

| Type | Rate | APY^ | Minimum |

|---|---|---|---|

| Share Savings | 0.06% | 0.06% | $5 Membership Share |

Rates are variable and subject to change. Minimum balance to open account, maintain membership and earn disclosed APY is $5.00. Fees may reduce earnings.

| Type | Rate | APY^ | Minimum |

|---|---|---|---|

| Holiday & Vacations Club | 0.06% | 0.06% | N/A |

Rates are variable and subject to change. No minimum opening balance or minimum balance. Credit Union Membership required. Fees may reduce earnings. Funds in these accounts are automatically transferred to your Share Savings Account on April 1st for Vacation Club and November 1st for Holiday Club. The accounts will remain open.

| Type | Rate | APY^ | minimum to earn apy^ |

|---|---|---|---|

|

IRA Money Market Roth IRA Money Market Coverdell IRA Money Market |

0.50% | 0.50% | $100 |

Rates are variable and subject to change. Minimum balance to open and avoid a service fee is $100. Credit Union Membership required. Minimum balances are required to earn disclosed APY. Fees may reduce earnings. If the account is closed before accrued dividends are credited you will not receive the accrued dividends. Transactions are allowed up to the current maximum annual contributions/distribution limits based on Federal IRA deposit limits and your personal tax situation, consult your tax consultant for further details.

| Amount | Rate | APY^ | minimum to earn apy^ |

|---|---|---|---|

| Insured Money Market | |||

| $0 - $10,000.00 | 0.50% | 0.50% | $2,500.00 |

| $10,000.01 - $25,000.00 | 1.45% | 1.46% | $10,000.01 |

| $25,000.01 - $50,000.00 | 1.60% | 1.61% | $25,000.01 |

| $50,000.01 - $100,000.00 | 2.00% | 2.02% | $50,000.01 |

| $100,000.01 & Above | 2.50% | 2.53% | $100,000.01 |

Rates are variable and subject to change. Minimum balance to open and avoid a service fee is $2,500.00. Credit Union Membership required. Minimum balances are required to earn disclosed APY. Fees may reduce earnings.

| Amount | RATE | APY^ |

|---|---|---|

| TopLine Savings | ||

| $5,000.00 - $24,999.99 | 2.08% | 2.10% |

| $25,000.00 - $49,999.99 | 2.76% | 2.80% |

| $50,000.00 - $99,999.99 | 2.86% | 2.90% |

| $100,000.00 - $149,999.99 | 3.74% | 3.80% |

| $150,000.00 - $249,999.99 | 3.83% | 3.90% |

| $250,000.00 & Above | 3.98% | 4.05% |

Rates are variable and subject to change. Minimum opening deposit is $5.00. Credit Union Membership required. Minimum balances are required to earn disclosed APY. Balances that fall below $5,000 will not earn dividends. Fees may reduce earnings.

Certificates

| Type | Rate | APY^ | minimum to open |

|---|---|---|---|

| Certificates | |||

| 6 Month | 4.18% | 4.25% | $1,000 |

| 12 Month | 1.71% | 1.72% | $1,000 |

| 18 Month | 1.84% | 1.85% | $2,500 |

| 24 Month | 1.96% | 1.97% | $2,500 |

| 36 Month | 2.45% | 2.47% | $5,000 |

| 48 Month | 2.73% | 2.76% | $5,000 |

| 60 Month | 2.87% | 2.90% | $5,000 |

Rates are fixed for the term of the certificate. Credit Union Membership required. Minimum balances required to open and earn disclosed APY. Fees may reduce earnings. Early withdrawal penalties apply. Additional deposits not allowed during the term of the certificate. Certificates automatically renew at current rate and term.

9 Month Certificate Special

| Type | Rate | APY^ | minimum to open |

|---|---|---|---|

| Certificates | |||

| 9 Month | 3.94% | 4.00% | $1,000 |

Rates are fixed for the term of the certificate. Credit Union Membership required. Minimum balances required to open and earn disclosed APY. Fees may reduce earnings. Early withdrawal penalties apply. Additional deposits not allowed during the term of the certificate. Certificates automatically renew at 12 month rate and term.

| Type | Rate | APY^ | minimum to open |

|---|---|---|---|

| IRA Certificates: Traditional, ROTH, & Coverdell | |||

| 12 Month | 1.71% | 1.72% | $500 |

| 36 Month | 2.45% | 2.47% | $500 |

| 60 Month | 2.87% | 2.90% | $500 |

Rates are fixed for the term of the certificate. Credit Union Membership required. Minimum balances required to open and earn disclosed APY. Fees may reduce earnings. Early withdrawal penalties apply. Additional deposits allowed during the term of the certificate. Certificates automatically renew at current rate and term. Transactions are allowed up to the current maximum annual contributions/distribution limits based on Federal IRA deposit limits and your personal tax situation, consult your tax consultant for further details.

Checking Rates

Effective Date: October 1, 2024

Rate means Dividend Rate

^APY means Annual Percentage Yield

See fee schedule for a list of applicable fees you may encounter.

| type | rate | ^apy | minimum to open |

|---|---|---|---|

| EveryDay Checking | 0.00% | 0.00% | $25 |

Credit Union Membership required. See the Fee Schedule for any applicable fees. For Everyday Checking accounts, minimum opening deposit of $25 required. For qualifying EveryDay Checking. you may also qualify for the Everyday Advantage Checking if you meet one the following requirements: A) you are between the ages of 13 and 23 or B) are enrolled in and receive e-Statements and one of the following. 1) have a minimum balance of $25,000.00 as stated in the Rate Schedule; 2) receive a minimum of $500.00 in direct deposit(s) monthly; 3) make 10 debit card transactions monthly; or 4) have a total of $5,000.00 in outstanding loan balances at the end of the month.