Mastercards®

Purchasing power whether your shopping online or in-store.

Managing your account is super easy too with access on your computer or mobile device.

Mastercard Gold®

-

Build Credit

-

Online Access 24/7

-

Make Payments Online

-

Balance Transfers

-

e-Statements Available

Mastercard Platinum®

-

Great Rate!

-

Year End Spending Summary

-

Make Payments Online

-

Balance Transfers

-

e-Statements Available

Mastercard Secured®

-

Establish or Rebuild Credit

-

Secure Your Card Limit With Your Existing Savings

-

Make Payments Online

-

Balance Transfers

-

e-Statements Available

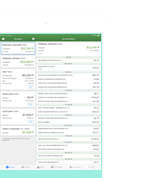

Credit Card Interest Calculator

This calculator will show you how much of your current credit card payment is being applied to the principal balance and how much is pure interest.

Important Credit Card Terms & Information

Effective Date: January 1, 2025

| INTEREST RATES AND INTEREST CHARGES |  |

|---|---|

|

Annual Percentage Rate (APR) for Purchases |

Platinum Mastercard 8.90%Gold Mastercard 11.90% |

|

APR for Balance Transfers |

Platinum Mastercard 8.90%Gold Mastercard 11.90% |

|

APR for Cash Advances |

Platinum Mastercard 8.90%Gold Mastercard 11.90% |

|

How to Avoid Paying Interest on Purchases |

Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month. |

|

Minimum Interest Charge |

If you are charged interest, the charge will be no less than $0.50. |

|

For Credit Card Tips from the Consumer Financial Protection Bureau |

To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore. |

|

Fees |

|

|

Transaction Fees - Cash Advance Fee

- Foreign Transaction Fee |

$2.00 or 2.00% of the amount of each cash advance, whichever is greater (Maximum Fee: $25.00) 1.00% of each transaction in U.S. dollars |

|

Penalty Fees - Late Payment Fee - Returned Payment Fee |

Up to $25.00 Up to $25.00 |